Time to elevate your business.

Lend lets you control the workflow of your brokers, with a holistic view of your pipeline and processes. Always up to date with compliance, reconciliation, and with the intelligent marketing capability to grow your business.

Built For Scale

/

Automated

/

Intelligent Insights

/

Third Party Integrated

/

Commercial & Consumer

Take a deep dive into all the features and solutions Lend offers.

Run your business

like never before.

Automated workflow

Customisable workflows

How complete is your application?

Freely define stages of your deal workflow. Automate outcomes based on event-driven triggers. Maintain full visibility and control over your business pipeline and drill down into performance metrics.

Automated processes

Unlock cutting edge efficiencies through automated client follow-ups, compliance,

lead-gen and broker workflows. Customise and manage white-labelled client and

referrer portals. Gather digital signatures from customers across your own range

of custom-built templates.

Compliance

Fully NCCP compliant.

Lend’s consumer finance workflows are fully compliant under NCCP legislation. We hold your hand through the process to minimise the risk of compliance slip ups.

Lend is your in house compliance manager for consumer finance.

Digital signatures

Centralised, accelerated execution.

Design, create and implement your own custom client facing documents for use in your application process.

Reducing subscriptions; streamlining your processes.

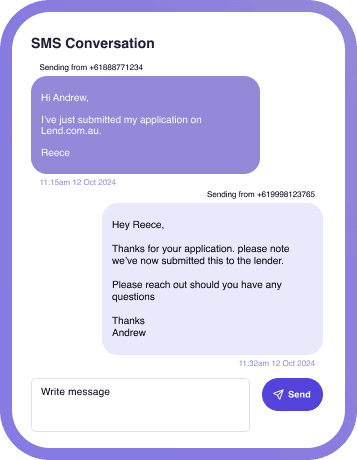

Automations

Do it all through Lend.

Ability to send automated task reminders, emails and SMS to clients, referrers and team-members.

Work faster. Work smarter.

Broker back office capabilities

Make end-of-month easier & streamlined.

Lend streamlines your back of office processes by communicating with referrers on settlements, automated emails and SMS capabilities, customisable reporting and comprehensive status history updates on active deals.

Transparent oversight of your business when you need it.

Lend insights & intelligence

Understand the true borrowing capacity of your client’s with Lend’s

marketing leading analysis and client profiling technology.

Analyse bank data in line with financier decision metrics to keep you

one step ahead of questions that may be asked by your chosen financier.

Automate analysis, improve efficiency.

Bank Statement Analysis

Make informed decisions. Quickly.

Analyse bank data in line with financier decision metrics to keep you one step ahead of questions that may be asked by your chosen financier.

Automate analysis, reduce risk.

LendScore

Making the likelihood of approval, likely.

Lend will profile your customer across multiple product verticals and capture share of wallet.

Profiling the customer and finding the right lender - share of the wallet.

LendSize

The right loan. The right loan size.

Utilise Lend's technology to effectively size the loan that your client is applicable for across multiple product verticals.

Loan sizes appropriate for clients - size of the wallet.

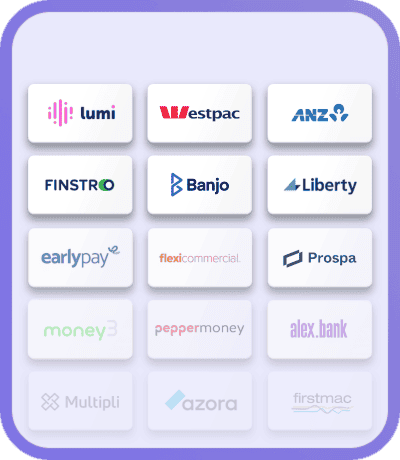

Integrations

Plays friendly with others.

Equifax, Creditorwatch, Ilion, ABN lookup, Redbook, Burst SMS, Sensis (phone and email verification) and many more.

Create efficiencies by having all these features housed under one roof.

GROW your business

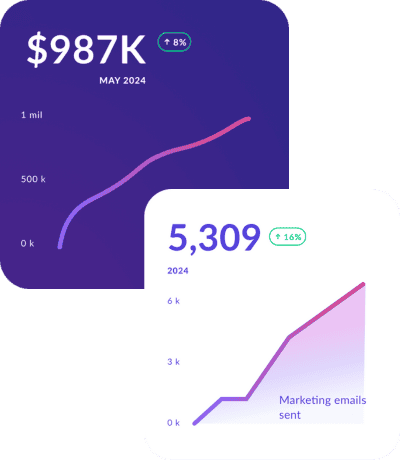

Cross-sell revenue

Capture wallet share, boost sales, win together!

Full matching engine capabilities across multiple product types with over 70 financiers. The ability to upsell based on personalised advice.

We keep up to date on the market shifts so you don't have to.

Marketing capabilities

Proactively target new opportunities.

Sophisticated marketing triggers email/SMS etc.

Tailor bespoke campaigns to your clients existing and upcoming requirements.

Predictive buying patterns

Knowing what products they are going to need and when they are going to need them.

Track your clients business over time and get ahead of their requirements for finance.

Access growing pool of lenders

Tough to place deals are a thing of the past.

Lend is always expanding it's financier pool and as we grow so does the brokers access to these financiers.

Tough to place deals are a thing of the past with Lend's ever growing financier panel. By using the system, you'll find a home for even the most complicated transactions. This saves you time in calling around trying to find a home for the deal.

Xero and MYOB financial analysis - Coming soon

True insights for submission.

Analyse your clients financial statements and generate servicing ratios that can then be turned into a full credit memorandum for submission.

Understand the true picture of how financiers will assess your client

Additional Features