Time to elevate

your business.

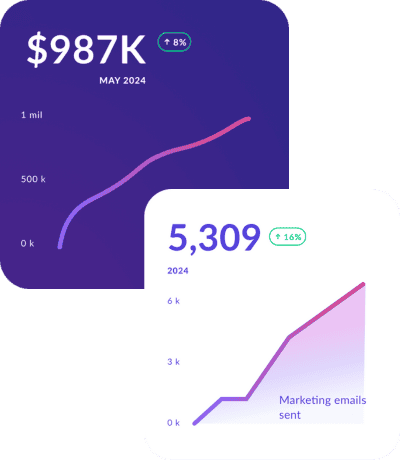

Lend lets you control the workflow of your brokers, with a holistic view of your pipeline and processes. Always up to date with compliance, reconciliation, and with the intelligent marketing capability to grow your business.

$1bn+

Processed loans

2000+

Users+

70+

Lenders & growing

NCCP

compliant

Built for scale

/

Automated

/

Intelligent Insights

/

Third Party Integrated

/

Commercial & Consumer

Take a deep dive into all the features and solutions Lend offers.

Run your business like never before.

Automated workflow

How complete is your application?

Customisable workflows

Freely define stages of your deal workflow. Automate outcomes based on event-driven triggers. Maintain full visibility and control over your business pipeline and drill down into performance metrics.

Get started for freeAutomated processes

Unlock cutting edge efficiencies through automated client follow-ups, compliance, lead-gen and broker workflows.

Customise and manage white-labelled client and referrer portals.

Gather digital signatures from customers across your own range of custom-built templates.

Fully NCCP compliant.

Lend’s consumer finance workflows are fully compliant under NCCP legislation. We hold your hand through the process to minimise the risk of compliance slip ups.

Lend is your in house compliance manager for consumer finance.

Lend insights & intelligence

Understand the true borrowing capacity of your client’s with Lend’s marketing leading analysis and client profiling technology.

Analyse bank data in line with financier decision metrics to keep you one step ahead of questions that may be asked by your chosen financier.

Automate analysis, improve efficiency.

Make informed decisions. Quickly.

Analyse bank data in line with financier decision metrics to keep you one step ahead of questions that may be asked by your chosen financier.

Automate analysis, reduce risk.

Grow your business

Capture wallet share, boost sales, win together!

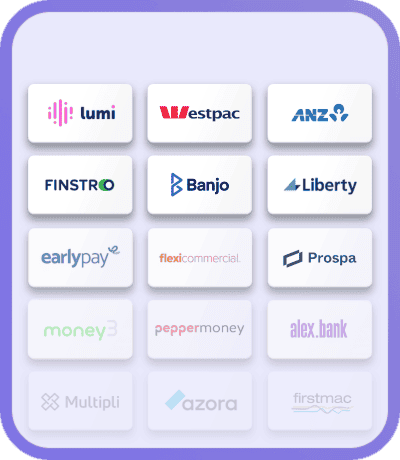

Full matching engine capabilities across multiple product types with over 70 financiers. The ability to upsell based on personalised advice.

We keep up to date on the market shifts so you don't have to.

Proactively target new opportunities.

Sophisticated marketing triggers email/SMS etc.

Tailor bespoke campaigns to your clients existing and upcoming requirements.

Predictive buying patterns

Knowing what products they are going to need and when they are going to need them.

Track your clients business over time and get ahead of their requirements for finance.

Tough to place deals are a thing of the past.

Lend is always expanding it's financier pool and as we grow so does the brokers access to these financiers.

Tough to place deals are a thing of the past with Lend's ever growing financier panel. By using the system, you'll find a home for even the most complicated transactions. This saves you time in calling around trying to find a home for the deal.

True insights for submission.

Analyse your clients financial statements and generate servicing ratios that can then be turned into a full credit memorandum for submission.

Understand the true picture of how financiers will assess your client

Additional features++

Real time support.

Real time support.

Support available to help grow your business, live chat support, ongoing training.

Lend's broker team has extensive experience in the space and will be with you at all times to assist with your needs and requirements.

Feedback & development.

Feedback & development.

Got feedback? Thought of a tweak or new feature that could enhance your experience? Lend is here to listen, develop and implement changes for the betterment of our users experience.

Most other CRM providers don't listen closely to their users. Lend is different, we understand that enhancing your experience in the platform is the most important thing. Once you're part of the Lend family, you'll never want to leave.

Leads, leads, leads.

Leads, leads, leads.

Lead generation to grow your business.

Integrate your Lend CRM today with Lend's lead generation services to create an all in one integrated business development solution.

Learn/earn CPD credits.

Learn/earn CPD credits.

CPD credits for business.

Learn whilst you earn. Now you can get your necessary/required CPD points whilst you use your CRM, learn and earn!